child tax credit 2021 dates and amounts

A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. A5 Amount on which family trust distribution tax has been paid 2021.

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

The California Earned Income Tax Credit CalEITC and the Young Child Tax Credit YCTC are state tax credits for working Californians.

. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. To find rules that apply for 2021. 2 adults and one child.

The tax agency continues to send weekly batches of the third stimulus checks with. The fully refundable credit is usually up to 2000 per qualifying dependent and is set to increase to 3600 in 2021. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

New 2021 Child Tax Credit and advance payment details. Here are the Canada Child Benefit dates for 2022. Dont think that the child tax credit payments going out in just over two weeks are all the IRS is focused on.

Individuals eligible for a 2021 Child Tax Credit will receive advance payments of the individuals credit which the IRS and the Bureau of the Fiscal Service will make through periodic payments from July 1 to December 31 2021. Amounts that you do not pay tax on 2021. The Recovery Rebate Refundable Tax Credit is listed on Form 1040 in 2020 and 2021.

The child tax credit is a credit that offsets the tax you owe dollar for dollar. Especially if they owed taxes or received a large refund when filing their 2021 tax return. Other new COVID-19 relief programs however contributed to the overall year-over-year increase in outlays.

If Amir is eligible we will use the information on their 2021 tax return to determine what amount they will get for the payment period starting in. Dates and amounts of tax deposits you made and acknowledgment numbers for deposits made by EFTPS. Will I keep getting the expanded credit amounts and the advance.

Whats new this year. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return. The eFile Tax App calculates your 2021 RRC for stimulus three.

The following information will help you with completing your tax return for 2021. Section 179 deduction dollar limits. Get reminders for important dates and deadlines.

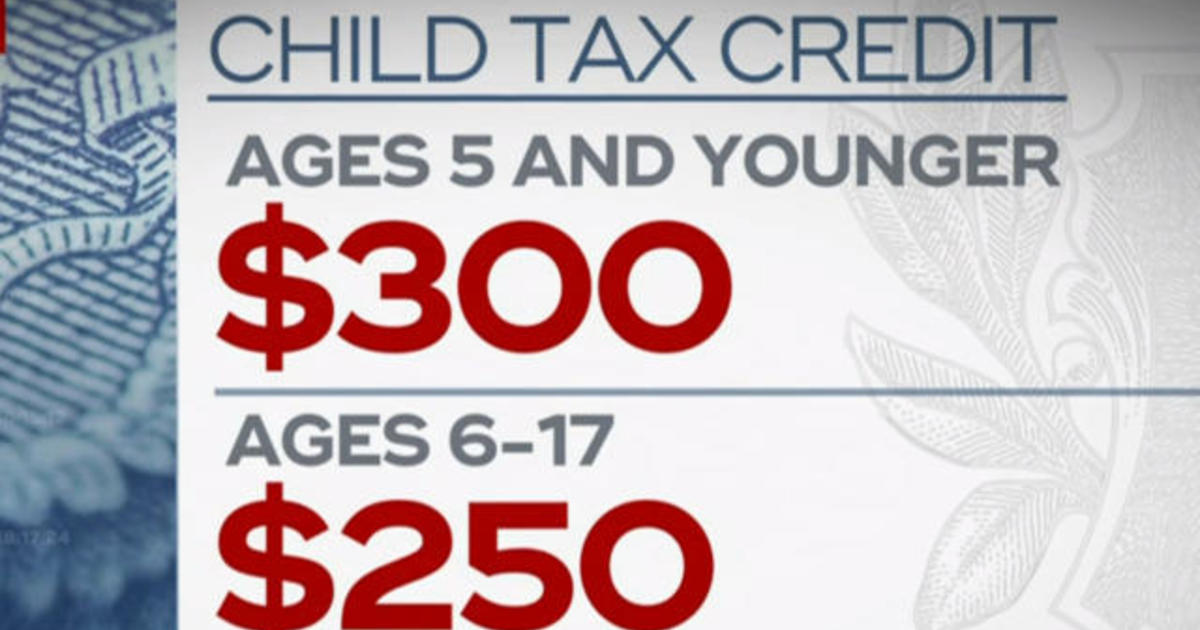

The IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per. The article below outlines the rules for the Child Tax Credit for tax years beyond 2021. This year the child tax credit will rise to 3600.

For more information see Line 58340 - Home renovation expenses. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Your amount changes based on the age of your children.

FBT Type 1 gross-up rate. To receive the OCB you and your spouse or common-law partner need to file your income tax and benefit returns and be. Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December.

Credit amounts will be made through advance payments during 2021. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Guidance under section 1446f.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. CCB payment amounts for July 2022 to June 2023 payment cycle are based on your familys net income for the 2021 tax year. Income tax refund or GSTHST credit.

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. A new refundable active families benefit tax credit has been introduced. That means the 2022 credit amount drops back down to 2000 per child it was 3000 for children 6 to 17 years of age and 3600 for children 5 years old and younger for the 2021 tax year.

New for Saskatchewan for 2021. For more information see Active families benefit AFB. Add the income amount to your wages on your 2021 income tax return regardless of when the excess deferral was made.

The payment for children. The Child Tax Credit Update Portal is no longer available. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning.

When Amir files their 2021 tax return the CRA will automatically determine if they are eligible for the GSTHST credit. The YCTC amount is up to 1000. April 1 2020 - December 31.

Learn more about the child tax credit income phase out rules and claiming additional credits with the tax experts at HR Block. The OCB and the Canada child benefit CCB are delivered together in one monthly payment. The Child Tax Credit amounts change as your modified adjusted gross.

It is not your tax refund. Child Tax Credit amounts will be different for each family. Transferor must withhold a tax equal to 10 of.

Expenditures for certain refundable tax credits such as the Advance Child Tax Credit payments that were expanded in pandemic-response legislation and rolled out in July 2021 rose by 38 billion 325 relative to this time last year. A new non-refundable home renovation tax credit has been introduced. The credits scope has been expanded.

When you prepare and e-file your 2021 Taxes do not include the amounts you received or believe you are owed from the 2020 RRC. Previously only children 16 and younger qualified. See terms and conditions for details.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. C1 Credit for. This change will allow struggling families to.

If the distribution was for the income earned on an excess deferral your Form 1099-R should have code 8 in box 7. Not claim the child tax credit or credit for other dependents in Step 3 of Form W-4 if the nonresident alien is a resident of Canada Mexico or. HR Block Maine License.

One adult and one child. Fringe benefits tax FBT rates and thresholds for employers for the 201819 to 202223 FBT years. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly.

The Ontario child benefit OCB is a non-taxable amount paid to help low- to moderate-income families provide for their children. 2021 then you qualify for the Young Child Tax Credit. These instructions are in the same order as the questions on the Tax return for individuals 2021.

The personal income levels and most non-refundable tax credits. If you qualify you may see a reduced tax bill or a bigger refund. This rate is used where the benefit provider is entitled to a goods and services tax GST credit in respect of the provision of a benefit.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. Loans are offered in amounts of 250 500 750 1250 or 3500. This credit applied to these dates.

The Tax Cuts and Jobs Act TCJA added section 1446f which generally requires that if the gain on any disposition of an interest in a partnership would be treated under section 864c8 as effectively connected gain the transferee purchasing an interest in such a partnership from a non-US. Amir is single with no children. Learn about the Canada Child Benefit CCB amount how it is calculated and application process.

If you didnt receive the distribution by April 15 2021 you must also add it to your wages on your 2021 tax return.

Irs Announces 2017 Tax Rates Standard Deductions Exemption Amounts And More Irs Taxes Standard Deduction Tax Brackets

Two Websites To Get Your W2 Form Online Online Taxes Filing Taxes W2 Forms

Pin By Joanne Kuster On Money Budgeting Ideas Budget Creator Budgeting Scholarships

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

2021 Child Tax Credit Advanced Payment Option Tas

Did Your Advance Child Tax Credit Payment End Or Change Tas

New Health Coverage Of Californians New Visions Healthcare Blog Aca Ppaca Physicians Medicaid Hix Healthcare Infographics Infographic Health News Health

Pin By Meredith Bg On Home Ideas Tax Credits Math Federation

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

If Itc Wrongly Availed Exceeds Rs 5 Crores It Would Be Cognizable And Non Bailable Offence Ponzi Scheme Cheating Bail

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Guide To 2021 Child Tax Credit Amounts Eligibility Becu

Tax Worksheets Tax Deductible Expense Log Tax Deductions Etsy Happy Planner Finance Planner Printable Planner

Parents Guide To The Child Tax Credit Nextadvisor With Time

We Are Accepting New Clients Schedule An Appointment Today Heights West End Taxes Payro Tax Quote Business Cartoons Salon Quotes

![]()

2021 Advanced Payments Of The Child Tax Credit Tas

The Human Brain Takes In Massive Amounts Of Information Every Single Day Read The Article On The Website Or In The Magazine Podcasts Teaching Parents Magazine